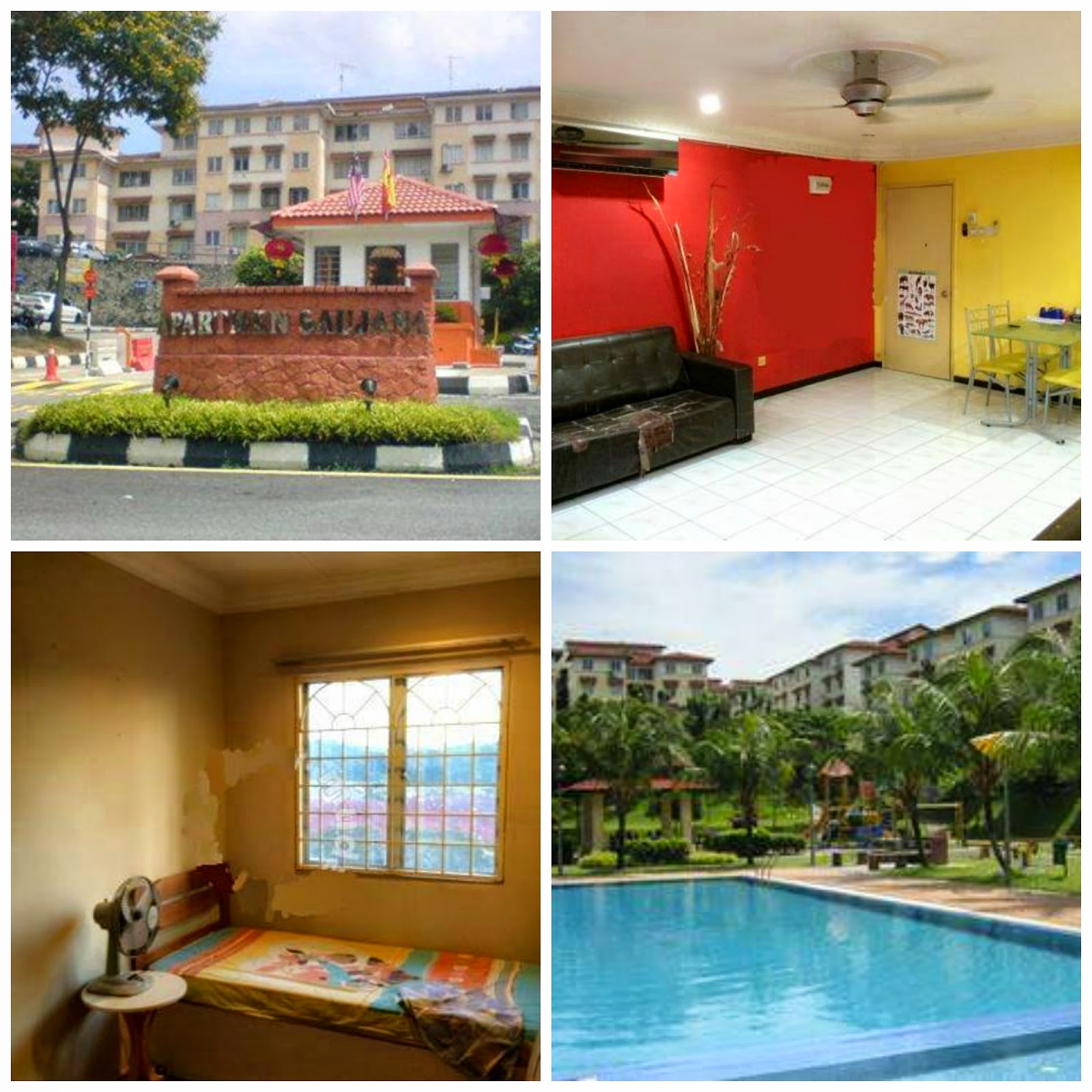

Langat Jaya Condominum, Cheras, Hulu Langat

RM 260 000

- Freehold / Bumi Lot

- 3 Rooms, 2 Bathroom

- 938 sq ft

- Level 11

- Pool view

Facilities:

- 24 hours security

- Swimming pool

- Gymnasium

- Tennis court

- Car park

Langat Jaya Condominium is a freehold condominium located at Jalan Datuk Alias, Taman Langat Jaya, 43200 Cheras, Malaysia. It has 2 blocks of 23 stories and the built up size is approx. 938 sqft per unit.

Facilities provided are gymnasium, tennis court, swimming pool, car park, mini market, playground and 24 hours security.

There are a few schools in the area with the closest being SK Bukit Raya. It is situated along Jalan Hulu Langat about a 5 minute drive away. Other schools nearby are Sekolah Sri Murni and Sekolah Rendah Agama Batu 9 to name a few. They are also situated along Jalan Hulu Langat but are about a 10 to 15 minute drive down.

There are several shops in the area as well as diners.

Lebuhraya Cheras-Kajang is a 10 minute drive from Langat Jaya Condominium via Jalan Hulu Langat, making it easy for residents to travel to and fro the condo.

Please contact:

EN DIN @ 018 2242 172

(Registered Real Estate Negotiator) - REN 03826

Credit to : carihartanah